The 2019 NFL Draft is going to be in Nashville this year and I couldn’t be more excited. The NFL Draft is one of my favorite sporting events. I love seeing a team’s strategy play out like a real-life chess board and I love seeing player’s dreams come true even more. What comes with these dreams is a contract and one that will pay out a lot of money. For many of these players, they become instant millionaires. But for others drafted in the later rounds, they won’t be instant millionaires. They will earn a great income, but they are going to be fighting for a roster spot every year to do so.

The way the NFL has set up the rookie contract is most of these deals are for 4 years. If you are a 1st Round Draft Pick, there is a team option for a 5th year. There is a formula that determines what your 5th-year earnings will be. Unless you are a 1st Round Draft Pick, you will hit free agency after your 4th year in the league. And if you went undrafted, you can hit free agency in your 3rd year. But the fact is, according to the Wall Street Journal and data provided by Pro-Football-Reference.com, the average career of an NFL player is 2.66 years. That means many players never get to a 2nd contract on the open market, where players will likely earn the most money they ever will in their career. The majority of players will only earn what their rookie contract pays. Players who are in the league 15+ years like Tom Brady, Peyton Manning, Adam Vinatieri are outliers and not the norm. With this information on hand, let’s analyze what a 1st Round Draft Pick, 3rd Round Draft Pick, and 6th Round Draft Pick will earn. The numbers may not be as large as you think they are.

The Assumptions

Before we start, we have to build some assumptions into the analysis.

Contract

For our purposes, we are going to assume every player will have a 4-year career with the team that drafted them.

They will not earn a 2nd contract or have their 5th-year option exercised.

We are will use the current Tennessee Titans draft picks as our guide. In this case, Round 1 – Pick 19, Round 3 – Pick 82, and Round 6 – Pick 188.

We will use the information provided by overthecap.com for our estimates on signing bonus and yearly base salary.

We will assume there are no roster bonuses associated with these contracts. Only the base salary and signing bonus.

A signing bonus is paid out the year the contract is signed but is apportioned over the length of the contract for salary cap purposes.

While there is definitely some negotiation on the payout of the contract, the most recent collective bargaining agreement negotiated by the NFLPA will give a pretty good idea on what a draft pick will earn per year and over the length of their contract.

Taxes

For tax purposes, we will assume each player files as Single.

We will assume the standard deduction increases by $200 each year.

We will assume tax brackets increase by 2% each year.

The state a player is drafted in has a big impact on the taxes they pay.

Someone drafted by a team in Texas will pay less in taxes than a player drafted by a team in California.

For our purposes, we will assume a player will pay 5% in state taxes.

A player pays taxes where the income is earned, not where they are a resident.

If a player is drafted by the Tennessee Titans, 8 out of the 16 games will have Tennessee income.

The other 8 games will have income in the states where those games are played.

The Earnings

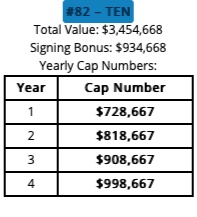

Here is the payout structure for a 1st Round Pick #19.

His total earnings before taxes are $12.66M and total earnings after taxes are $7.5M. This is definitely someone who, with the right guidance and advice, could live off their portfolio income and create generational wealth with only their first contract. They will need to be careful to not get caught up in the trappings of a millionaire lifestyle.

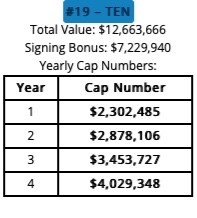

Here is the payout structure for a 3rd Round Pick #82.

His total earnings before taxes are $3.45M and total earnings after taxes are $2.17M. While this player should be able to have a paid off house, vehicle, and save a decent amount of money in retirement accounts, it will take a concerted effort to live off their portfolio income and create generational wealth with only their first contract. Assuming the player is 25-26 at the end of the contract, that is a very long time horizon to live off of what may be a $1M portfolio. In my opinion, they would need to save about 75% of their net after taxes earnings for this to happen. And even then, they would be living a pretty frugal lifestyle.

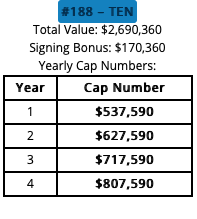

And our last example is the payout structure for a 6th Round Pick #188.

His total earnings before taxes are $2.69M and total earnings after taxes are $1.72M. This player will be able to earn a nice income while in the league but is aiming to get that lucrative 2nd contract. They should be able to have a paid off house, vehicle, and a solid start towards retirement savings, but would need to save almost 90% of their net after taxes earnings to create generational wealth. Just like in the 3rd Round Pick example, they will be 25-26 at the end of their rookie contract and that is a long time horizon to live off of what may be a $1M portfolio. This would require an even more frugal lifestyle.

A rookie NFL contract can be an incredible opportunity to create wealth and lift people into a different socio-economic class; but, for the majority of NFL players, they should be very careful to plan for a future without football.

The Pitfalls That Can Come With A Financial Windfall

While a player can earn an incredible salary playing in the NFL, they will need to be very smart and tactical with their money to be financially prosperous long term. A player drafted into the NFL is blessed with this great salary, but there are unique challenges behind the scene that typically come with it. There is a bit of financial whiplash going from no money to becoming an overnight millionaire. A player will want to put down roots in their new city with a house, buy a vehicle, get married and start a family if they are at that point in their life, help family members who have taken care of them, etc. And I haven’t mentioned training, fitness, and nutrition expenses, disability insurance premiums, starting side businesses, or even the jump of going from an amateur to professional athlete!

One of my favorite documentaries is the "30 for 30" documentary “Broke”. Whether you are a professional athlete or work in a cubicle, I don’t know if it’s possible for me to recommend this documentary enough. It details many of the trappings a professional athlete can find themselves in if they get caught up in being young and rich. There was an article Sports Illustrated published that also speaks on “How (and Why) Athletes Go Broke”. While written in 2009, it stated that “within 2 years of retirement, 78% of former NFL players have gone bankrupt or are under financial stress because of joblessness or divorce.” And it isn’t only NFL players that experience this. The same article stated, “within 5 years of retirement, an estimated 60% of former NBA players are broke”.

Setting Up A Professional Athlete For Long-Term Success

Like on the field, a professional athlete needs a strong team off-the-field team. You need an agent who is always looking out for your best interests, an accountant who is well versed in the tax implications athletes find themselves in, an attorney with an impeccable work ethic and reputation, and a financial advisor who you and your entire team trust to put your interests ahead of their own. Everyone on your team should be willing and able to explain complex ideas and strategies in a way that educates and teaches you. If a team member gets defensive if you start asking questions, you may need to look into them further. Do not hire a family member or a friend for any of these advisor positions. Your off-the-field team members should have no problem telling people who approach you with business ideas “No”. And most important, you need everyone on your team to hold you accountable when needed. A “Yes-Man” has no place on your team of advisors.

As a financial advisor, I would recommend athletes use this as a very general guideline for investments. First, an athlete should avoid private equity while they are building their investment portfolio. You will be approached by almost everyone you have ever met with their “can’t fail” business idea. Send these people to your advisor team for proper vetting. While investing in private companies can be exciting and invigorating, the truth is the vast majority of these ventures will fail. In fact, 90% of startups fail according to Small Biz Trends. Athletes have a high risk/high reward mindset and it’s generally suited them well so far in life. But in the case of an investment portfolio – boring is best! A portfolio consisting of passive ETFs that track the stock and bond markets should make up at least 80-90% of your portfolio. I would allocate no more than 5-10% of your portfolio towards alternative investments like real estate, commodities, and precious metals for further diversification. And if you are the entrepreneurial type, I would put the rest of your portfolio towards a business you can focus on once your playing career is over. Simple and boring - yet effective.

Getting drafted is an exciting time in a player’s life. It represents a lifetime achievement and incredible opportunity in the years ahead. Once the celebration is over, a player should make sure to take care of things off the field to ensure the most success for when their playing career is over. Because the reality is, there will come a time when you will not be a professional athlete. There is an incredible opportunity to take care of your family for generations to come – make sure you have the right people in place to do the blocking and tackling to allow you to reach the financial end zone.

Full Disclosure: Nothing on this website should ever be considered to be advice, research or an invitation to buy or sell any securities. Please see the Disclaimer page for a full disclaimer.

About The Author

Shaun Melby, CFP® provides fee-only financial planning and investment management services in Nashville, TN. Melby Wealth Management serves clients as a fiduciary and never earns a commission of any kind. Shaun has over 10 years of experience as a financial advisor in Nashville.